Find out what payment processors do, how they make money, and how you can save money on payment processing.

If you want to see how much your business depends on accepting credit card payments, unplug your credit card terminal for fifteen minutes and watch the ensuing chaos.

No question about it: credit cards are a part of doing business. And anyone who accepts credit cards needs a payment processor to make it happen.

So how do they make money? And how can you save–and even eliminate–paying money for payment processing? Let’s find out.

First: a quick recap on how payment processing works

We don’t need to repeat our entire blog on how credit card processing works.

Instead, we’ll give you the TL;DR version in four steps.

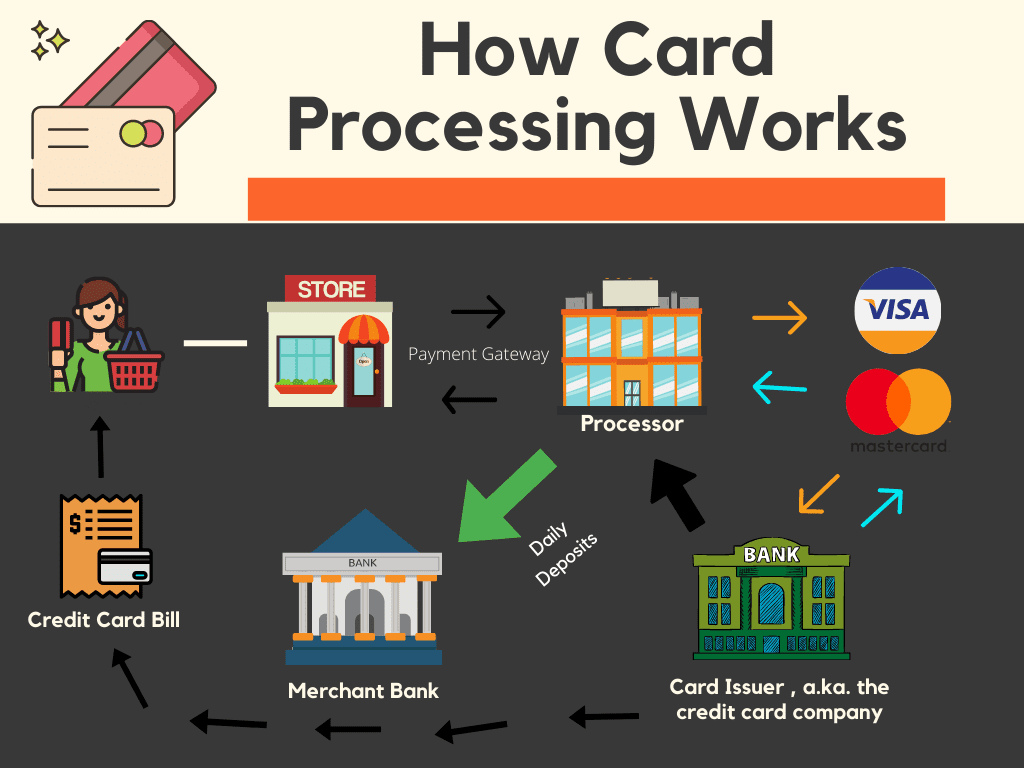

When a customer pays with their credit card:

- The credit card terminal sends a request for payment authorization to the business’ payment processor.

- That payment processor tells the customer’s bank to send funds through the card association (Visa, Mastercard, etc) and includes the customer’s credit card number, expiration date, and CVV number.

- The customer’s bank approves it, confirming they have enough money in their account. That payment approval from the customer’s bank gets sent through the card association to the business’s bank.

- At the end of the day, the business ‘batches’ or settles their payments via their payment processor, where the payment actually gets removed from the customer’s account and put into the business’ bank account minus the transaction fees.

Because every credit card payment has to take place quickly and securely, it’s not a simple process. That means a number of parties had to be involved to make sure everything went smoothly with each credit card payment.

Now that we know all this, let’s answer the big question: how do payment processors make money?

So how do payment processors make money?

As you skimmed through these four steps, did you notice how often the payment processor was involved?

Let’s make it clear: each party gets paid for their part (banks, card associations, etc). But it’s the payment processor who collects these fees. That’s why they are the ones who get paid by a business who accepts credit card payments. From there, they pay the other parties their cut.

So no matter the business, every time someone uses a credit card, payment processors make money by managing that credit card payment.

Does that mean it’s the same rate, no matter the payment processor?

Do all payment processors charge the same?

Different payment processors charge different amounts to process their clients’ credit card payments. This is because of a number of reasons, but we’ll focus on the two biggest factors: pricing structures and payment processor greed.

Pricing structures

Different payment processors offer different pricing structures. Our blog about different pricing structures for processors goes way more into depth on this, but basically there’s basically three types of pricing structures: flat rate, tiered, and Interchange Plus.

TL;DR pricing structure summary:

- Flat rate is fine if you accept less then $2,000 a month in credit cards. After that, you’re paying too much

- Tiered is a ripoff because you end up paying way more than you should

- Interchange plus pricing provides the lowest cost for any business accepting more than $2,000 a month

Interchange Plus provides the lowest processing costs for the vast majority of businesses because they’re only paying the cost of sending the financial information (the ‘Interchange’ part) plus the amount the processor charges for doing it (the ‘Plus’ part).

Payment processor greed

But even if two processors are both using Interchange Plus with their clients, they still may charge very different amounts for their processing services. It’s up to them to decide how much to charge their clients.

To make even more money off their customers, some processors sneak in meaningless fees in their contracts with unsuspecting customers.

Progressive Payment Solutions hates how big processors charge sky-high fees and provide horrible customer service. To help businesses like you avoid them, we wrote a blog exposing how big processors are taking advantage of small businesses.

Not only that, but PPS guarantees our clients the lowest fees in the industry (and doesn’t charge any hidden or unnecessary fees). Contact us today if you’re ready to start saving money with a family-owned payment processor.

How payment processors make money from Zero-Fee Processing

By now, you’ve probably seen us talking about Zero-Fee Processing (also known as Cash Discounting) in our other articles. And for good reason: businesses eliminate 100% of their processing fees by using Zero-Fee Processing.

But that doesn’t mean those processing fees go away; rather, those processing fees get passed on to other parties. When customers choose to use their credit card instead of cash or checks, they accept responsibility for paying the fees that come from using a credit card.

Those fees are added to their subtotal as a ‘NCC’, or non-cash charge. That way, they pay the fees instead of your business.

Zero-Fee Processing has grown 86% in the past five years, netting an average of $20,112 in annual savings for businesses who use it. Plus, it’s easy to set up. Check out our calculator tool that lets you see how much you’ll save with Zero-Fee processing. Or if you’re ready to get started or have questions, schedule a free meeting today.

How knowing this affects your business

Even though every processor charges fees for accepting credit card payments, that doesn’t mean you’re paying the same for payment processing as the next business. Some processors charge more than others because they’re using more-expensive pricing structures or are simply greedy.

Not only that, but many businesses make the smart choice of using Zero-Fee Processing to never again pay for credit card processing.

If you’re ready to start saving on processing or are ready to eliminate fees altogether, then contact us today.