Find out everything your dental practice needs to know when it comes to accepting credit cards. We go into how to reduce costs, avoid fees, accept HSA/FSA cards, and everything else that will benefit dentists like you.

There’s no way around it: Your dental office needs to accept credit cards

Why do the vast majority of consumers–including your dental patients–prefer to pay with credit cards? Put simply, credit cards are:

- Easy

- Safe

- Convenient

These are the top three reasons consumers choose credit cards as their preferred form of payment.

Their use has become universal, spanning across various industries–which includes dental businesses. Really, dentists today can’t afford to not accept credit cards as a form of payment from their patients.

But what else do you need to know about a typical dental patient? Let’s find out.

We’re becoming a cashless society

As technology continues to advance, society is gradually moving towards a cashless economy. Not so long ago, wallets were thick, cumbersome items filled with coupons, pictures, and especially cash. But not any more.

Our society now relies more on convenient electronic transactions, including credit cards, debit cards, and mobile payments. By accepting credit cards, dental practices can align themselves with this societal shift, making it easier and more convenient for patients to pay for their services.

Battling Inflationary Pressures

In a post-pandemic world, inflation has been a hot-button item across political parties, industries, and even global economies. And after years of fighting it, it doesn’t appear to be settling down anytime soon.

Inflation can pose challenges for both consumers and businesses. As prices rise, the purchasing power of cash diminishes over time.

By accepting credit cards, dental practices can provide their patients with an alternative payment method that offers protection against inflation. Credit cards allow patients to defer payment until the statement due date, helping them manage their expenses more effectively.

Escalating Insurance Costs

Inflation doesn’t just affect the cost of a loaf of bread or a sheet of plywood.The cost of dental insurance for both patients and dental practices continues to rise as well.

Accepting credit cards can offer a solution for patients who may be underinsured or facing high out-of-pocket expenses. Credit cards provide a flexible financing option, enabling patients to pay for dental treatments over time, reducing the burden of immediate payment.

Financing options for dental patients

Credit cards can serve as a powerful tool for dental practices by allowing patients greater flexibility if they are struggling with other bills. By accepting them, they offer the patient the ability to spread payments out over a period of time, thus increasing their ability to manage their funds effectively.

This, in turn, allows dental practices to make their services more accessible and affordable, ultimately attracting a broader range of patients.

Easier record keeping

Efficient record keeping is crucial for dental practices to maintain accurate financial records and ensure smooth operations. Accepting credit cards simplifies this process, as transactions are automatically recorded in the merchant’s account. The use of digital payment systems also reduces the risk of errors associated with manual record keeping, improving financial transparency and accountability.

Not only does this benefit dental practices, but patients as well. Their use of their credit cards at a dentist allows them to keep track of how much was paid and when–a feature especially crucial for those who are spreading those payments out over time.

Enhanced Patient Satisfaction and Security

As already established, credit cards are the preferred form of payment for the vast majority of the US. Thus, a dental practice accepting credit cards can significantly improve patient satisfaction.

Patients often feel safer and more secure using credit cards, as they offer built-in fraud protection and dispute resolution mechanisms. Credit card transactions are also more traceable, providing patients with a clear payment trail for their records. This increased sense of security and convenience contributes to a positive patient experience, enhancing the reputation of the dental practice.

Attraction of New Patients

When a patient is considering which dentist to go to, they are going to look at more than just if they are in-network to their insurance; they will also examine the availability of credit card payment options as a decisive factor when choosing a dental practice.

With a significant portion of the population relying on credit cards for their financial transactions, dental practices that accept credit cards have a competitive edge over those that only accept dental insurance, cash or checks. By catering to the preferences of a cashless society, dental practices can attract a larger pool of patients, boosting their revenue and reputation.

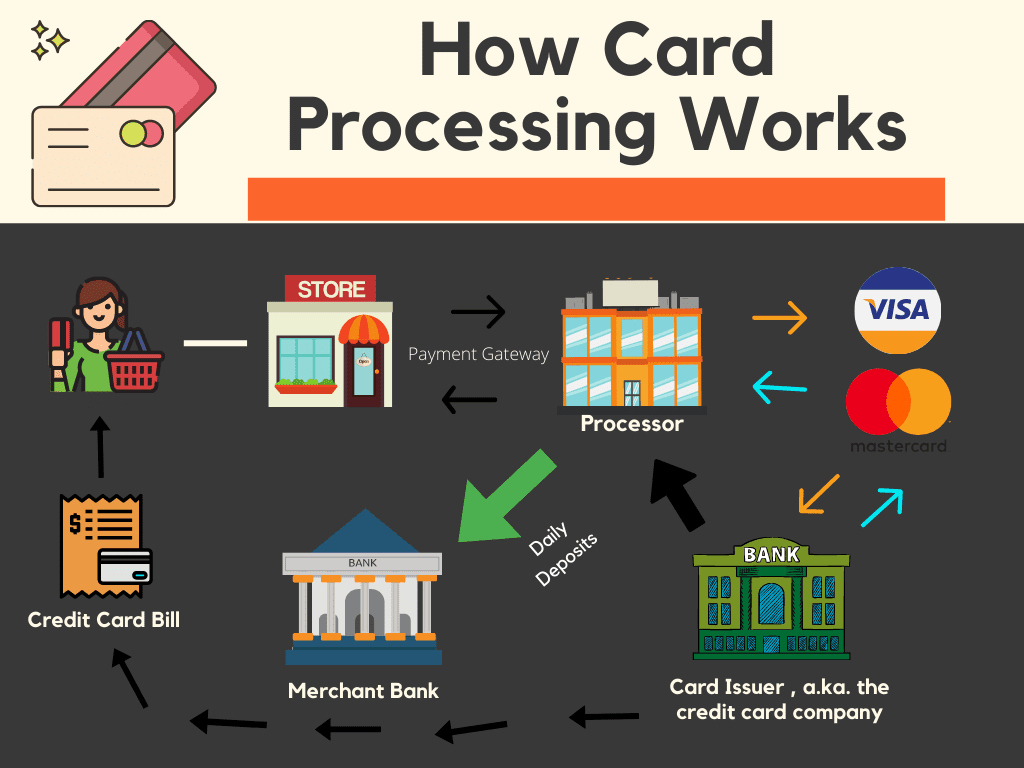

How credit card processing works

Before we can help your dental practice save money on credit card processing, we need to first explain how it works.

In order for credit cards to offer convenience and flexibility for both consumers and businesses, there are some very important parties at play behind the scenes. We’ll next explore the fundamentals of credit card processing, different methods of accepting credit cards, examples of how processing works in a transaction, the origin of credit card fees, and how processing fees are paid.

Introduction to payments with credit cards

While the system behind credit card processing is complex, a dental practice can navigate the world of card payments with confidence once they understand the basics of credit card processing, different methods of accepting credit cards, the transaction flow, the origin of credit card fees, and where processing fees come from.

This knowledge empowers dentists to make informed decisions, select the right payment processing solutions, and provide a seamless payment experience for their patients.

Different ways to accept credit cards

Let’s start with what your dental office first needs: a way to accept credit card payments. Thanks to advances in technology, practices now have several options when it comes to taking a credit card payment:

Point-of-Sale (POS) Systems

This is by far the most common way to accept a credit card. They might be large or small, simple or complex, basic or feature-rich–regardless of its components, this is always the device a dental patient will see when they go to present their credit card at the front desk.

But no matter what model your practice uses, any modern system will utilize specialized hardware and software to process credit card transactions that include mag-stripe readers, chip card slots, or NFC tap-to-go readers. These terminals securely capture card data and connect to a payment gateway for authorization.

Mobile Payment Solutions

In the past decade, smartphone use has exploded. With over 14 billion mobile devices, people are using them for everything–including paying their dentist.

Thus, a modern dentist will offer a way to leverage these mobile payment methods via mobile apps or card readers that can be attached to smartphones or tablets, allowing dental offices to accept payments even faster than before.

Online Payment Gateways

Some patients prefer to pay online. That means dentists need an online payment gateway to facilitate payments made via the web, letting customers enter their card details on a secure webpage. From there, the payment gateway processes the transaction in real-time.

How credit card processing works in a transaction

Now that you know how payments to your dental practice can be made, it’s time to dig a little deeper. While there are many parties that are in charge of a wide-array of responsibilities and tasks, we’ll just focus on the basics that will affect your dental practice.

When a patient makes a credit card payment, several steps occur to complete the transaction:

Authorization

The merchant sends the customer’s card details, transaction amount, and other necessary information to the acquiring bank or payment processor. The bank verifies the card’s validity, checks for available funds, and approves or declines the transaction.

Clearing

After authorization, the acquiring bank sends the approved transaction to the credit card network (e.g., Visa, Mastercard). The network routes the transaction to the issuing bank for further verification and authorization. This is basically the waiting process while everything surrounding the transaction is confirmed to be correct.

Settlement

Up until this point, the money hasn’t actually been transferred from one account to another. Rather, it’s in an in-between point where everything is still being verified. If the transaction is voided, your office won’t be charged anything.

However, once the transaction is authorized and cleared, the funds are transferred from the customer’s issuing bank to the merchant’s acquiring bank. This process, known as settlement, typically occurs within a few business days. If the transaction is reversed at this point, then your dental office will be charged a ‘chargeback’ fee and it will then be considered a refund.

Unraveling Credit Card Fees

Credit cards have revolutionized the way we make payments, but for a cost. In other words, they’re not free to use. In fact, it’s far more expensive to pay with a credit card compared to more traditional means like cash or check.

In order for everything to take place quickly, smoothly, and securely, a number of parties are at work. Not surprisingly, each one of these parties charges a fee for their services.

Credit card fees are simply an unavoidable part of the cost associated with accepting credit card payments. They include several components:

Interchange Fees

Interchange fees are paid to the card-issuing banks for their role in authorizing and processing transactions. These fees are set by the card networks and vary based on factors like transaction type, card type, and risk level.

It’s important for merchants like dentists to understand that these Interchange fees are non-negotiable and that everyone is charged at the same rate.

Assessment Fees

Assessment fees are charges imposed by the card networks (e.g., Visa, Mastercard) for the use of their payment infrastructure. These fees are typically a small percentage of the transaction value.

Markup or Processing Fees

Payment processors, acquiring banks, or independent sales organizations (ISOs) charge additional fees to cover their services, technology, customer support, and risk management.

Here’s where dentists should start to pay attention if they’re looking to save money: These markup or processing fees are negotiable and vary among providers. That means your dental practice may be paying more or less for processing than the one half a mile away. We’ll get into what you can do with this information later on.

How fees get paid

Now that we understand how credit card processing works and where fees come from, the question remains: who’s going to pay them?

When all is said and done, the responsibility for paying processing fees is typically borne by the merchant. Depending on the arrangement with their payment processor or acquiring bank, the fees may be deducted directly from the merchant’s bank account. In some cases, fees may be invoiced separately, and the merchant settles them through a separate payment.

However, this is not the case for dentists who make the wise choice of using Zero-Fee Processing. We’ll get into how it works later on. But if you want to know all about it, be sure to visit our Zero-Fee Processing page.

Now that we know that some fees are negotiable, it’s important for dental practices to understand the fee structure in order to negotiate competitive rates to minimize the impact on their bottom line.

However, there’s far more to saving your dental practice money than just negotiating fees. The fact is that the right credit card processing structure can completely eliminate every cent of your payment processing costs. Let’s get into that next.

Credit Card Processing Pricing Structures: Choosing the Right Option for Your Dental Practice

It’s time to get into the part of payment processing that will mean the most for your bottom line: choosing the right processing pricing structure. In this section, we’ll explore different types of pricing structures for credit card processing, how they impact your dental practice’s revenue, and how to choose the right option.

Why different types of pricing affects you

Choosing the wrong pricing structure for your dental practice can cause payment processing to be the biggest expense for your practice after payroll, costing you five figures or more a year.

You read that correctly: choosing the wrong pricing structure can cost your dental practice upwards of five figures each year.

Which shows just how important identifying the best one is for your practice.

This huge cost comes down to how the fees associated with each structure can vary based on how transactions are grouped, types of transaction volume, average ticket size, card types, and other factors.

However, the opposite is also true: a dental practice that selects the right pricing model can save thousands per month, along with enjoying transparency, simplicity, and ease of financial management.

Tiered pricing

Tiered pricing, also known as bundled or qualified pricing, categorizes transactions into tiers or rate categories. These categories typically include qualified, mid-qualified, and non-qualified rates. The rates are predetermined by the processor based on factors such as transaction type, card type, and risk level.

While tiered pricing might appear to be the simplest, most straightforward pricing structure, it’s really not. In reality, tiered pricing lacks transparency, resulting in higher overall costs for dentists.

How? Because much of the ‘tiers’ that transactions are grouped into are expensive to process. And who decides which tier a transaction belongs to? It’s usually the sole decision of the processor. That means that the entity that you pay can basically tell you to pay more by misclassifying your transactions–without you even knowing about it.

If you want to know more, check out our article about why tiered pricing is the most expensive credit card processing model.

Interchange Plus pricing

Interchange Plus pricing, also called cost-plus pricing, provides dentists with transparency and a more accurate representation of the fees associated with each transaction.

Note to dentists: this is often the least expensive pricing model (except for Zero-Fee Processing, which is discussed further down). That’s because it involves passing on the actual interchange fees set by the card networks and adding a fixed markup or percentage fee for the payment processor.

That means that Interchange Plus is the way to go–unless you’re only doing a few thousand dollars a month at your dental office. Not surprisingly, Interchange Plus pricing is often preferred by businesses that handle a high volume of transactions or those with larger average ticket sizes.

Flat rate pricing

Next on our list is flat rate pricing, which can simplify the fee structure by charging a single, fixed percentage fee for all transactions.

This pricing model is popular among small businesses and individuals who want straightforward pricing without the complexity of tiered or interchange fees. However, it’s again important for you to analyze how much credit card volume your dental practice is doing.

If you’re doing only a few thousand or less a month in credit card transactions and aren’t being charged monthly fees, then flat rate pricing might be fine for your dental practice. But flat rate pricing will not be cost-effective for dental offices with high transaction volumes ($5,000 or more a month) or larger average ticket sizes.

Zero-Fee Processing

To say that Zero-fee Processing, also known as cash discounting pricing, has gained attention in recent years is an understatement. In fact, Progressive Payment Solutions has seen Zero-Fee Processing grow 86% in less than five years.

This is because this model allows businesses like dental practices to completely offset processing costs. This happens by advertising the price of a service as the price paid with cash or check.

But if the patient still chooses to use their credit card to pay their bill, then a fixed percentage fee is added to the total as a ‘Non-Cash Charge’ (NCC) to offset the processing fee.

Thus, Zero-Fee Processing completely eliminates processing fees for dentists. It does so by incentivizing the patient to use cash or check (which doesn’t cost the dental practice anything), or else the patient accepts paying these fees by using their credit card. This 50-state approved program is becoming more and more common across various industries, including dental practices.

To help you see the exact amount your practice will save by using Zero-Fee Processing, use our free online credit card processing fee calculator. All you need is how much your practice takes in via credit card payments each month and you’ll instantly see the amount you’ll save with Zero-Fee Processing.

Tiered vs Zero-Fee pricing

Now that we’ve examined each credit card processing pricing structure for dentists, it’s easy to see that Zero-Fee Processing is the least expensive way to accept credit card payments for dentists. But is it right for your practice? Let’s compare them to find the best fit for you.

Let’s start with tiered pricing structures vs Zero-Fee Processing. Again, tiered pricing structures can lead to higher costs for businesses, as they lack transparency since each tier that a transaction falls into is chosen by the processing company, not by the dentist. This means a lot of transactions are grouped into a more expensive tier, along with any additional hidden fees that are included by dishonest payment processing companies.

Zero-fee processing, on the other hand, can significantly reduce or eliminate processing costs altogether for dentists. The dentist’s biggest consideration with implementing Zero-Fee Processing is to evaluate customer perception and potential changes in purchasing behavior due to the final prices being higher on their invoice, which will include a non-cash charge (NCC) of 3-4% of the total.

Many dentists have already successfully implemented Zero-Fee Processing from PPS by simply reminding the patient to bring their checkbook to their appointment to avoid a small fee added to their total.

Interchange vs Zero-Fee pricing

Remember: Interchange Plus pricing is the most affordable and most transparent traditional pricing model for practices doing over $3,000 a month in credit card processing volume, allowing dental offices to understand and control their costs more effectively.

However, Zero-Fee processing can still provide improved savings for dentists that are willing to adjust their pricing strategy and patient experience.

Flat rate vs zero-fee pricing

With the simplicity and ease of use offered by flat rate pricing, it still won’t be the most cost-effective option for businesses with higher transaction volumes. Zero-Fee Processing, however, is guaranteed to reduce costs for dentists by allowing patients to accept them or choose another form of payment, leading to substantial savings.

Choosing the right pricing structure for your dental practice

After examining the different pricing structures and comparing them with one another, you may still not be sure of which one is right for your dental practice.

To make it as simple as possible, you should base your decision on your dental practice’s specific needs, transaction volume, average ticket size, and patient preferences.

You should also consider your goals regarding your dental practice: are you looking to grow your bottom line? Increase your revenue? Have extra cash flow for reinvestment into your practice or for other pursuits?

To help you identify the best pricing structure for you, take the following steps:

1. Evaluate your dental practice’s transaction volume and average ticket size

2. Assess the potential impact on patient perception and purchasing behavior

3. Analyze the overall costs associated with each pricing model, including any additional fees or program costs

4. Research and compare different payment processors, their pricing models, and customer reviews (for help with this, see our article on what to look for in a payment processing company)

5. Seek advice from other dental professionals or consultants that have experience in making these choices, along with those who have successfully run their dental practice for years.

Remember, this decision can mean a savings of over $20,000 a year for your practice–or, conversely, it can result in you paying over $20,000 a year unnecessarily because of using the wrong processing model and paying too much for fees.

With this fact in mind, a smart dentist will do their research by understanding the differences between tiered pricing, interchange plus pricing, flat rate pricing, and Zero-Fee processing in order to make an informed choice. By doing so, you can optimize your payment processing costs while delivering a seamless payment experience for your patients.

Need help making a choice? The representatives at Progressive Payment Solutions are ready to help you by answering any questions that you may have. Book a call today to get the information you need to make the best decision for your practice.

Dental management software

Anyone who has worked at a dental office knows there’s far more to it than just cleaning and caring for teeth. The fact is, managing a dental practice involves various administrative tasks, patient records, appointments, billing, and more.

A major way to get control of all these tasks and make running things easier is with dental management software. This software has emerged as a game-changer for dentists across the country, revolutionizing practice operations and enhancing overall efficiency.

In this section, we will get a clear understanding of what dental management software is, why they’re important for dental practices, what their potential drawbacks are, which popular options are available in the market, and what steps you can take to save money on this software.

What is Dental Management Software?

Also known as dental practice management software or dental software, it is a digital solution designed to streamline and automate various aspects of dental practice operations. In other words, dental management software is all about making it easier to run your dental practice.

Dental management software combines essential functions like appointment scheduling, patient records management, treatment planning, billing and invoicing, insurance claims processing, and reporting into a single integrated platform.

On top of that, it is also beginning to handle functions that never existed 15 years ago, such as social media management. Put this all together, and dentists have an ever-improving digital solution to a handful of problems and tasks.

Why is Dental Management Software important?

Some dentists are unconvinced of the importance of this new software. However, taking this stance can put a practice at risk of falling behind, failing to meet the new standard of care. This risk, along with alienating their practice from patients that have come to expect certain benefits that only dental management software allows, are among the most important reasons any smart dentist will consider using this software.

To help you understand its importance in your practice, take a look at what specific benefits dental management software offers that are quickly becoming essential for any dental practice:

Streamlined Operations

We’re all relying more and more on digital means of staying organized, and dental practices are no exception.

Dental software reduces manual effort and increases productivity by automating administrative tasks. Not only does it avoid missed appointments and deadlines, but it also improves appointment scheduling, simplifies patient record-keeping, and streamlines billing and claims processes.

This all comes together to create a dental practice that can focus on providing the best care to patients rather than having to shift manpower towards caring for administrative tasks.

Enhanced Patient Care

With quick, easy access to comprehensive patient records, dental management software allows dental professionals to provide personalized and informed care to each patient. This translates to improved treatment planning, progress tracking, and follow-up reminders that are technologically facilitated to not miss a beat, resulting in improved patient satisfaction and outcomes.

Improved Efficiency and Accuracy

We all know the toll that human error can take on something as organized as providing ongoing dental care. The fact is, humans forget, make mistakes, or misinterpret data, resulting in patients not getting treatment reminders, not getting a needed appointment scheduled, or even receiving the wrong dental procedure in some cases.

Dental software eliminates this from happening by taking these mistakes out at the source: replacing manual data entry errors with automated practices. Not only that, but it also improves organization by reducing the paperwork involved. This, in turn, streamlines workflows, allowing staff to focus on patient care and improving accuracy and efficiency across all practice functions.

Financial Management

Last but not least, dental management software improves one of the most important aspects of any successful dental practice: managing your practice’s finances, providing improved clarity, simplicity, and enhanced security. It does all this by helping practices track and manage billing, insurance claims, and financial reports that help avoid mistakes or problems.

Dental management software can also open up new opportunities for a practice via the decision making insights it can provide. These, in turn, can enable those managing a dental practice to streamline revenue cycles, monitor financial performance, and make informed decisions for improved practice growth.

Drawbacks of dental management software

Unquestionably, dental management software offers numerous benefits, with more and more advantages being developed each year thanks to technological advances.

However, it’s essential for smart dentists to also consider its potential drawbacks in order to make an informed decision about using it with their practice.

Here are the most common downsides of dental management software:

Lack of processor options

The greatest drawback of dental management software is how the majority of them aren’t open API, which means you’re locked in to whatever systems and processor they choose. This equates to far higher costs for processing fees, which negates the financial management advantages we listed above.

However, if it does have an open API (such as Open Dental, which is listed below), you can integrate your dental management software with your own payment processor, saving your dental practice tens of thousands of dollars a year.

Cost

Not surprisingly, a system that provides all of the benefits listed above doesn’t come for free. Smart dentists need to consider the total cost of ownership, along with the time involved in implementing an entire new system.

It’s important to note that implementing dental software involves both an initial investment (which varies based on the features and scalability of the software that’s used) along with a monthly or yearly subscription cost that many software systems require.

Along with these two costs are certain features that may be extra, including what comes in each plan, such as the number of users a system may accommodate.

Learning Curve

As with anything else, transitioning to a new way of doing things involves learning. This is true of any software system, which will require time, effort, and potentially more money to train your staff to use it.

Certain staff members may need more time to become familiar with the software than others, potentially causing a temporary decrease in productivity during the implementation phase along with possibly more tension within the office.

Technical Issues

Even though dental management software can solve problems and eliminate human errors, it’s not still not perfect and never will be. The fact is, all software can have bugs, issues, or glitches, and dental software is no exception.

While all users will encounter technical issues such as system downtime or compatibility problems sooner or later, some systems are more prone to these issues than others. That’s why it’s crucial to select reliable software providers with good customer support to minimize these disruptions. We’ll get into that next.

What to Look for in Dental Management Software

By now, you’re at least curious about using dental management software at your practice. But what will you need? Remember that no software can do everything. That means you will have to choose what matters most to you.

However, there are a number of aspects you should ensure your software has in order for it to make life easier, more efficient, and to be worth the money, time, and effort required to get it going.

Here are the most important aspects of effective dental management software:

Easy to use

What good does a complicated system do if it causes more problems than it solves? Or worse yet, if it’s too complicated for your staff even to start using?

Make sure the software is easy to learn and lets your staff do common office tasks quickly and easily. Look at individual software reviews to find out what others say about the learning curve and if it requires extensive training for your staff.

Clear, helpful dashboards

You should be able to access records and collect data in real time. It’s important that the data is presented in an easy-to-understand way. A good dashboard can do all of this and more.

A positive patient experience

There are differences among software solutions that may affect a patient’s experience. After all, it’s not just about your office and staff; this software can either attract patients or drive them elsewhere.

That’s why it’s important to ask:

- Is it easy for patients to change their appointments or make a payment?

- Will patients of all ages and backgrounds be able to use it?

- Do patients get appointment reminders in the way they prefer?

Data analytics

When managing a practice, it’s important to use data to make informed decisions. Tracking metrics like new patients per month, case acceptance rate, patient retention, billing, and collections can provide valuable insights. Analyzing this data and identifying trends can help keep a practice thriving and growing.

Automation

Automation is present in all software. However, the key is to make it useful enough to automate repetitive tasks to free up time for important matters. Dental office management software needs to be able to handle appointment reminders, payment acceptance, payment reminders, patient data access and presentation, and insurance transaction recording.

HIPAA privacy and security

Since this software will touch on serious legal matters surrounding security and privacy, you’ll need to find the answers to some important questions:

- How is patient information kept secure?

- Is the software explicitly HIPAA compliant?

- Does it have safeguards for protecting patient data at every step?

You might be surprised to learn that HIPAA privacy and security standards are basically the same as PCI compliance, which are the standards needed for you to accept credit cards. (By the way, PPS helps you meet those standards, unlike many other payment processors).

Understand what you’re paying for

This software is designed to save money along with time and effort. That means you should find out the following:

- Is the software a one-time purchase or a monthly subscription?

- What features are included with the subscription?

- How many users will the software allow?

It’s important to understand exactly what you’re paying for and why. Look for a simple fee structure which will make planning and budgeting easier.

Integration with other systems

If you’ve got software systems already in place that you want to use (such as our Zero-Fee Processing program), it’s important to make sure your new dental office management software can work with them smoothly. That means you should look for an open API which will let the data flow effortlessly between systems.

Popular options for dental management software

Fortunately for dentists, there are several dental management software options available which cater to all sorts of different practice sizes and needs.

Not only that, but dental management software that doesn’t have an open API puts you at the mercy of any software that’s overly expensive, leaving you with no options other than to pay whatever they charge.

Here are some of the most popular dental management software options:

Open Dental

We put this first for a very important reason: Open Dental has an open API, allowing your practice the freedom to customize your software or integrate it with other systems like Zero-Fee Processing.

As an open-source dental management software, it provides flexibility and unique, individualized options for practices of all sizes.

Dentrix

One of the most popular systems available, Dentrix is a widely used and comprehensive dental management software that offers a range of features for efficient practice management.

However, many have noticed it can be overly expensive, thus not providing the value many dentists are hoping to receive from software that’s partly designed to save money. Not only that, but it can also be hard to use, leading to frustration of staff and excessive errors.

Eaglesoft

Eaglesoft provides robust features for scheduling, billing, charting, and communication, along with offering a user-friendly interface.

Curve Dental

Those looking to grow may want to consider Curve Dental. This is because this cloud-based dental software solution offers easy accessibility, scalability, and integration capabilities.

Steps to save money on dental management software

Again: good dental management software should save you money to be worth it, not just time and effort.

So to help you invest in the right dental management software, consider the following steps to save money:

Research and Compare

Looking at all the factors listed above with just some of the products we mentioned may take time–but it’s entirely worth the effort for your practice. So view this as an important investment, just like you invested in your schooling or equipment.

Understand your practice’s specific needs and compare multiple software options. Considering such factors as functionality, scalability, customer reviews, and pricing models will help narrow down the software that’s right for you.

Subscription vs. License

Evaluate whether a subscription-based model or a one-time license fee aligns better with your practice’s budget and long-term goals. Subscription models often offer more affordability and flexibility.

Utilize Free Trials and Demos

Take advantage of free trials or demos offered by software providers. This allows you to explore the software’s features and assess its suitability for your practice without committing to a purchase.

Negotiate Pricing

Not surprisingly, dental management software pricing isn’t written in stone. So don’t hesitate to negotiate pricing with software providers. Many vendors are open to offering discounts or customized packages based on your practice’s needs.

Consider Cloud-Based Solutions

Cloud-based dental software eliminates the need for expensive hardware installations and upgrades. It offers cost savings in terms of infrastructure maintenance and data backups.

Training and Support

Inquire about the cost of training and ongoing support from the software provider. Comprehensive training and reliable customer support can help minimize additional expenses in the long run.

As our lives become more intertwined with technology, dental management software will continue to play a vital role in optimizing dental practice operations, enhancing patient care, and improving overall efficiency.

While there are potential drawbacks and costs associated with implementing such software, the benefits far outweigh the initial investment. By researching available options, negotiating pricing, and considering important aspects like having software that’s open API, dental practices can save time, money, and hassle while investing in the most important aspect of their practice: providing the best dental care to their patients.

Harness the Benefits of HSA/FSA Cards in Your Dental Practice

With insurance costs climbing higher and higher, patients are looking for ways to keep dental care affordable. One way to do this is by means of HSA and FSA cards. Find out what you need to know about accepting them at your dental practice.

What are HSA/FSA Cards?

HSA (health savings account) and FSA (flex spending account) cards are payment cards linked to tax-advantaged healthcare accounts. That means both HSA and FSA accounts let workers set aside pre-tax money to pay for qualified medical expenses.

HSAs are available to individuals enrolled in high-deductible health insurance plans, while FSAs are employer-sponsored accounts that allow employees to set aside pre-tax dollars for eligible medical expenses.

How Do HSA/FSA Cards Work?

HSA/FSA cards work similarly to debit or credit cards. They are linked to the respective account and allow individuals to make payments for qualified healthcare expenses directly at the point of service. The funds used for payment are deducted from the account balance, which is typically funded by contributions from the account holder or their employer.

Why Do Dentists Need to Accept HSA/FSA Cards?

As mentioned above, HSA and FSA accounts are an increasingly-attractive choice for those who are looking to keep their health services affordable. Here’s how accepting HSA/FSA cards can benefit your dental practices:

Attracting Patients

If people have dedicated funds that they can only use on approved medical expenses, they’re always going to want to use that instead of paying out of pocket. That’s why offices who accept HSA/FSA cards can attract new patients who prefer to use these cards for healthcare expenses, thereby expanding their patient base.

Increased Patient Affordability

HSA/FSA cards make it easier for patients to pay for dental services without straining their budgets, as they can use pre-tax dollars to cover treatment costs.

Faster Payment Processing

Dental offices may be surprised to learn that accepting HSA/FSA cards actually streamlines payment processing, reducing paperwork and minimizing the hassle of reimbursements.

How to Accept HSA/FSA Cards

Fortunately, you don’t need specialized equipment to accept HSA or FSA cards. Instead, any credit card machine can accept them as long as they are PCI compliant in order to comply with HIPAA requirements of electronic health care transactions and security.

To accept HSA/FSA cards in your licensed dental practice, follow these steps:

1. Confirm Card Acceptance:

Check with your payment processor or merchant services provider to ensure that your payment system is compatible with HSA/FSA card transactions.

2. Set up a Card Reader:

Use a card reader that supports HSA/FSA card payments or ask your payment processor for guidance on integrating the necessary functionality into your existing system.

3. Train Staff:

Provide training to your staff on how to handle HSA/FSA card transactions and educate them about the benefits of these cards for patients.

These simple steps are all it takes for you to expand your practice by accepting these forms of payments.

NOTE: Progressive Payment Solutions is happy to help you accept HSA and FSA payments at your dentist practice. Contact us today to find out about how we can provide your practice with the equipment and PCI compliance needed to accept HSA and FSA payments.

How to let patients know you accept HSA & FSA

Now that you know what it takes to accept HSA and FSA cards, it’s time to inform your customers about it to attract more patients. Here’s how:

Website and Marketing Materials

Update your website, social media profiles, and marketing materials to highlight that you accept HSA/FSA cards as a convenient payment option.

Office Signage

Place visible signage in your practice, such as at the reception desk or waiting area, indicating that you accept HSA/FSA cards.

Verbal Communication

Train your front-desk staff to inform patients during appointment scheduling or at check-in that HSA/FSA cards are accepted.

Can all dentists accept HSA & FSA cards?

Any licensed medical practice can accept HSA and FSA cards, provided they take the steps listed above. However, it’s important to note a few considerations when accepting HSA/FSA cards to help patients understand how they work and what they entail:

- Eligible Expenses: Familiarize yourself with the IRS guidelines regarding qualified dental expenses covered by HSA/FSA funds to ensure compliance.

- Network Participation: Verify whether your dental practice is part of the networks associated with HSA/FSA card providers to avoid potential payment issues.

- Communication with Insurers: Collaborate with patients’ insurance providers to ensure smooth processing of HSA/FSA card payments and minimize potential claim rejections.

Potential Challenges for Patients

Even though patients with an HSA or FSA card will be happy that you accept them, they still may encounter challenges when it comes time to use them.

Here’s how to help patients overcome the following challenges when using HSA/FSA cards:

Additional Information Needed

Some patients may require additional documentation or information from the dental practice to submit for reimbursement or substantiation of expenses. Having this information ready for them on a dedicated document will help them quickly overcome this problem.

Year-End Spending

Patients often save HSA/FSA funds until the end of the year, resulting in a sudden rush of appointment requests during this period. Proper scheduling and accommodating patients promptly can help manage the influx, along with using dental management software to send a reminder email or text about this to avoid patients being caught off guard.

Insufficient or Expired Funds

Patients may face declined transactions if their HSA/FSA cards have insufficient or expired funds. It’s essential to educate patients about managing their accounts and staying updated on available balances while also being ready to offer alternative forms of payment to complete the transaction.

Accepting HSA/FSA cards in your dental practice can significantly benefit both your patients and your business. By offering this convenient payment option, you attract new patients, enhance affordability, streamline payment processing, and improve overall patient satisfaction.

Ensure compatibility with HSA/FSA card transactions with your payment processor, effectively communicate acceptance to patients, and stay informed about the guidelines and potential challenges associated with these cards. By doing so, you create a seamless payment experience and support your patients’ financial well-being while delivering exceptional dental care.

How credit card processing effects HIPAA compliance

There are two extremely-sensitive pieces of information that dental practices have access to: their patient’s medical history, and their credit card information when a payment is made. Smart dentists make sure they understand how credit card processing impacts compliance with HIPAA.

Let’s explore the relationship between credit card processing and HIPAA compliance, focusing on protected health information (PHI), data storage and transfer, breach notifications, policies and procedures, and the role of Payment Card Industry (PCI) compliance in ensuring HIPAA compliance regarding credit card information.

Protected Health Information (PHI)

Every person’s health records in the United States are protected under HIPAA: the Health Insurance Portability and Accountability Act. These regulations also safeguard PHI, which includes any individually identifiable health information held or transmitted by a covered entity or business associate. It may surprise some to learn that this also includes credit card information.

When patients make payments using credit cards, their personal and financial information may be involved. Therefore, dental practices must handle credit card data with the same level of security and privacy as PHI.

Data storage

Not surprisingly, credit card data must be securely stored to maintain HIPAA compliance. Dental practices should implement robust security measures such as encryption and access controls in order to protect credit card information from unauthorized access or breaches.

Storing credit card data in compliance with Payment Card Industry Data Security Standard (PCI DSS) requirements can also contribute to maintaining HIPAA compliance.

Data transfer

When dental practices process credit card payments, there is a transfer of sensitive data between the practice, payment processors, and financial institutions. To ensure HIPAA compliance, this data transfer must occur through secure channels. Implementing secure protocols such as Secure Sockets Layer (SSL) or Transport Layer Security (TLS) encryption when transmitting credit card data helps protect against unauthorized interception or access.

Breach notifications

Dental practices should establish comprehensive policies and procedures that address credit card processing while adhering to HIPAA guidelines. These policies should outline safeguards for protecting credit card data, employee responsibilities, incident response plans, and ongoing staff training to ensure compliance. Regular reviews and updates to these policies and procedures are necessary to address evolving threats and regulatory changes.

Policies and procedures

Maintaining compliance with the PCI DSS standards provides a strong foundation for HIPAA compliance when it comes to credit card information. PCI DSS standards are specifically designed to protect credit card data, and they encompass many security practices and measures required by HIPAA. By adhering to PCI compliance requirements, dental practices establish robust data security practices, reducing the risk of credit card data breaches and ensuring alignment with HIPAA standards.

It’s important to remember that patients are putting their trust in a dental practice in more ways than one. Not only are they trusting they’ll receive the best care, but also that their private information will be kept secure and confidential.

That’s why dental practices should carefully examine that they’re HIPAA compliant to safeguard patient data. Protecting credit card information, in line with HIPAA regulations, involves implementing secure data storage and transfer protocols, promptly notifying breaches, establishing comprehensive policies and procedures, and adhering to PCI compliance requirements.

By taking a proactive approach to credit card processing security, dental practices can ensure the confidentiality, integrity, and availability of both PHI and credit card information, thereby building trust with patients and meeting regulatory obligations.

Fortunately for dentists, PPS is happy to help your practice become PCI compliant. Contact us today to get the help you need to protect patient information.

Payment processor red flags

By now, you can see how important choosing a helpful, reliable and reputable payment processor is crucial for dental practices. Partnering with the right payment processor lets you save money, grow your bottom line, and solve any issues while helping you meet security standards.

Unfortunately, not all processors are trustworthy. Some may exhibit red flags or warning signs that your practice should be aware of in order to avoid problems, expensive hidden fees, or tricky contracts.

Find out what are the common red flags that dentists should watch out for when selecting a payment processor.

Expensive pricing structures

As we discussed earlier, not all pricing structures are what they appear to be. For instance, tiered pricing is often the most expensive and the least straightforward. Using a payment processor that employs an exorbitant pricing structure will significantly impact your bottom line.

Be sure to look out for payment processors that also charge high transaction fees, monthly minimums, or excessive percentages of sales. Compare pricing options and choose a processor that offers competitive rates aligned with industry standards.

Lack of customer support

Too many dentists only care about their bottom line without taking the time to realize how good customer service actually will save them money. How?

Prompt and reliable customer support is vital for resolving issues quickly. If a payment processor lacks responsive customer support or leaves you waiting for extended periods to address concerns, it can disrupt your practice’s operations and compromise patient satisfaction. That means you may not be able to accept payments all day, which will then cost you customer loyalty down the line.

If you need more information, we wrote an article all about how important customer support is for your dental practice.

Bad Google reviews

The information age we’re living in lets anyone share their opinion with the world–which is a godsend when it comes to finding neutral, unbiased information on a payment processor. That’s why conducting thorough research on payment processors and checking their online reputation can save you money and hassle.

Negative reviews and customer complaints on platforms like Google can serve as red flags, indicating potential issues with the processor’s service, reliability, or transparency. (It’s also worth noting that PPS has glowing reviews).

Additional/hidden fees

Some payment processors may introduce additional or hidden fees that are not clearly disclosed upfront. Watch out for charges such as statement fees, PCI compliance fees, setup fees, or cancellation fees. Transparent pricing is essential to avoid unexpected financial burdens. For more information, see our article that provides a comprehensive list of fees to avoid.

High-pressure sales tactics

Beware of payment processors that employ high-pressure sales tactics to push you into quick decisions or long-term contracts. Reputable processors will allow you time to review and compare their offerings without applying undue pressure, whereas dishonest processors will simply want to hook you to make money off your dental practice.

“Free” equipment (that’s not actually free)

Be cautious of payment processors offering “free” equipment as part of their service. In some cases, the equipment cost may be bundled into higher processing fees or long-term commitments. Evaluate the overall costs and terms associated with the equipment before making a decision.

Lengthy, confusing contracts or auto-renewals

Here’s an important fact: a lengthy contract isn’t required by many credit card processors. So why do some want you to sign on for months or even years? Because they know you will want to go somewhere else once you realize you’re paying too much.

That’s why you should avoid payment processors that have contracts that last a long time or automatically renew without providing sufficient notice or an opportunity to review the terms. Auto-renewals can lock you into extended agreements without your consent or the ability to negotiate better terms.

Confusing language

Pay attention to the language used in the contract or any other documentation provided by the payment processor. Sometimes complex or ambiguous terms may indicate potential pitfalls or hidden clauses that could negatively impact your practice.

The fact is, your payment processor should want to work with you, not against you. That means they should provide a clear, reasonable contract that is easily explained if you have any questions. If that’s not the case, it’s best to look elsewhere.

For more information on what else to avoid, see our article on what to avoid in a credit card processing contract.

Banking lies

Beware of payment processors that make false claims or misrepresent their relationships with banks. Verify the processor’s partnerships and ensure they work with reputable banking institutions. Trustworthy processors will provide accurate information and openly disclose their banking relationships.

Lack of experience with dentists

Make sure to choose a payment processor that has a documented experience working with dental practices. This will help you save time, since they will be familiar with the unique requirements and regulations associated with dental transactions, ensuring seamless integration and compliance.

This will also save you money, as a payment processor who has worked with dentists is aware of their unique needs, such as how to make sure they accept HSA or FSA cards and which pricing structure is best for them.

Not PCI compliant

As we have already established, PCI compliance with dental offices is vital to maintain HIPAA standards, to protect patient data, and maintain secure payment processing. Ensure that the payment processor you choose is fully PCI compliant and follows industry best practices for data security in order to avoid any potential problems such as a data breach which can result in heavy fines.

Selecting a trustworthy payment processor is crucial for dental practices to maintain smooth operations and protect patient information. By being aware of red flags such as long contract periods, expensive pricing structures, lack of customer support, negative reviews, hidden fees, high-pressure sales tactics, misleading offers, auto-renewals, confusing language in contracts, lack of experience with dentists, and non-compliance with PCI standards, dentists can make informed decisions.

How do you know which payment processor is right for you? Make sure you take the time necessary to conduct thorough research, seek recommendations, and compare multiple options to find a payment processor that prioritizes transparency, reliability, and the specific needs of your dental practice.

PPS is happy to answer any questions you may have about payment processing for your specific dental practice. Contact our New Jersey-based customer service representatives today for clear, helpful answers to your questions.

How dentists can best use savings from Zero-Fee Processing

Building and maintaining a successful dental practice requires more than just good service; it also requires strategic financial management. As a dentist, wisely utilizing your savings can help you achieve long-term growth and stability.

At this point in our guide, you’ve already learned how Zero-Fee Processing can save your dental practice over $20,000 a year by having other parties pay for the processing and fees associated with accepting credit card payments.

However, one question still remains: what does that mean for your practice?

Let’s explore the best ways for dentists to invest their savings, focusing on investing in their current practice, personnel, future expansion, and even starting a parallel/side business. By making informed investment decisions, you can optimize your savings and help your dental career progress to new heights–which is exactly what Progressive Payment Solutions is all about.

Invest in your current dental practice

One of the most effective ways to utilize your savings is by reinvesting in your current dental practice.

Consider investing the funds you save in these endeavors:

Technology and Equipment Upgrades

Patients will always want the latest and best in dental care. That’s why staying at the forefront of dental innovation by investing in state-of-the-art technology and equipment is a wise investment; doing so can enhance patient care, increase efficiency, and attract more clients, ensuring a steady profit stream for years to come.

Facility Renovations

Many patients are no longer willing to settle for a sterile, clinical setting for their dentists. So consider the importance of creating a comfortable and modern environment for your patients by investing in facility upgrades. Renovations can include improving waiting areas, treatment rooms, and the overall aesthetics of your facility to create a memorable patient experience that will keep them coming back for years.

Marketing and Advertising

Like never before, successful dentists invest in who they are and how they appear to patients. Allocating funds towards targeted marketing campaigns can expand your patient base, creating a dental practice that’s a recognizable brand. This can include online marketing, social media advertising, search engine optimization, and local community outreach.

Invest in personnel

The above efforts may fall flat if those who provide the actual patient care aren’t cared for themselves. The fact is, your dental practice’s success is greatly influenced by your team.

Consider investing in your personnel by:

Continuing Education and Training

Allocate funds to support your team’s professional growth through continuing education courses, conferences, and training programs. This will enhance their skills and keep them up-to-date with the latest advancements in dentistry.

Employee Benefits and Incentives

Offer attractive employee benefits packages, including health insurance, retirement plans, and performance-based incentives. This can help attract and retain talented staff, fostering loyalty and dedication.

Team Building and Well-being

Organize team-building activities and prioritize the well-being of your staff. Consider investing in initiatives such as wellness programs, team outings, and incentives for achieving work-life balance.

Invest in your future expansion

If you have ambitions for expanding your practice, see how you might use your savings from our Zero-Fee Processing program to invest in future growth:

Opening Additional Locations

Evaluate the idea of opening new branches in strategic locations. Conduct thorough market research, assess patient demand, and develop a solid business plan before embarking on expansion.

Specialized Services or Departments

Consider diversifying your practice by incorporating specialized services or departments, such as orthodontics, cosmetic dentistry, or oral surgery. This can attract a wider patient demographic and increase revenue streams.

Collaborating with Specialists

Explore partnerships or collaborations with dental specialists to expand the range of services your practice can offer. This can enhance the comprehensive care you provide to patients and strengthen professional relationships within the dental community.

Start a parallel/side business

Diversifying your income sources can provide additional financial stability and opportunities for growth. Consider starting a parallel/side business that complements your dental practice:

Dental Supply Distribution

Use your industry expertise to establish a dental supply distribution business, providing essential products to other dental practices in your region. This can capitalize on your existing network and generate additional income.

Dental Consulting or Coaching

Share your knowledge and experience by offering dental consulting or coaching services. This can involve advising other dentists on practice management, marketing strategies, or clinical expertise. Doing so can also elevate the public’s perception of your existing dental practice’s brand.

Dental Education or Training Programs

Develop and deliver dental education or training programs for aspiring dental professionals. This can include workshops, online courses, or mentorship opportunities, leveraging your expertise to contribute to the dental community.

Using your savings from Zero-Fee Processing wisely requires careful consideration and strategic planning. By investing in your current practice through technology upgrades, facility renovations, marketing initiatives, and personnel development, you can enhance patient care and attract more clients.

Additionally, exploring opportunities for future expansion, such as opening new locations or diversifying services, can fuel long-term growth. You may decide to start a parallel/side business that can provide additional income streams and leverage your expertise beyond your dental practice. With a clear vision and prudent financial decisions, you can make the most of your savings and build a thriving dental career.

Dealing with patient objections to Zero-Fee Processing

Unquestionably, Zero-Fee Processing is the easiest way for dentists to grow their bottom line. Because of this, it has gained massive popularity recently, with an 86% increase in just five years.

However, some dentists may encounter objections and questions from their patients when implementing this payment model. But by understanding and effectively addressing these objections, dentists can navigate the transition smoothly while maintaining patient satisfaction.

Let’s look at the best ways to address the most common concerns and objections from both staff and patients regarding Zero-Fee Processing.

Will my patients be upset?

It is natural to have concerns about patient reactions to a fee associated with credit card transactions. However, as this form of processing becomes more popular, consumers are increasingly accustomed to fees in various industries. By transparently communicating the fee structure and providing clear explanations, patients are more likely to understand and accept the change.

How do I properly notify patients?

Properly notifying patients is crucial to maintaining transparency. Clearly display signage at the point of sale, inform patients when it comes time to accept payment, and update your website and marketing materials to explain the Zero-Fee Processing policy. Train your staff to answer questions and provide clear information regarding the NCC (non-cash charge) fee.

Patient question 1: ‘Why is there a fee?’

Patients may question the fee associated with Zero-Fee Processing. Explain that the fee is in place to cover the cost of credit card processing. Emphasize that by utilizing cash or alternative payment methods like checks, patients can avoid the fee altogether.

Patient question 2: ‘How can I avoid the fee?’

Inform patients that they can avoid the fee by paying with cash, check, or, in some cases, alternative payment methods such as mobile wallets (e.g., Apple Pay, Google Pay). Encourage patients to consider the benefits of these payment options and the potential rewards they may receive by using them.

Patient question 3: ‘Is this illegal?’

Zero-Fee Processing is legal in all 50 states. However, it is essential to comply with local regulations and card network guidelines. Consult with a reputable payment processor like PPS to ensure compliance with all applicable laws and regulations.

Patient 4: ‘Why should I pay the fee?’

Educate patients about the cost of credit card processing, which includes transaction fees, card network fees, and other associated costs. Highlight the convenience, security, and additional benefits they receive when paying with a credit card. Emphasize that the fee allows dentists to continue offering these payment options while minimizing their impact on prices.

Patient question 5: ‘This fee seems high’

If patients perceive the fee as high, provide a breakdown of the associated costs and explain that the fee is proportionate to the processing fees imposed by card networks. Highlight the convenience, rewards, and buyer protections associated with credit card usage to help patients understand the value they receive despite the fee. Having all of this information on a pre-printed document may be all that is needed to help them understand the cost.

Patient question 6: ‘Can I use Apple Pay, Google Pay, etc?’

If your practice is equipped with the correct terminal that accepts these forms of payment, you can assure patients that they can still use their preferred payment methods such as mobile wallets (e.g., Apple Pay, Google Pay). Encourage the adoption of these contactless payment options, as they often offer added security and convenience.

Implementing Zero-Fee Processing is a strategic decision that businesses make to offset the costs associated with credit card processing. By addressing common objections and concerns from both dental staff and patients, it is possible to foster understanding and maintain patient satisfaction throughout the transition.

Transparent communication, clear signage, and well-trained staff play crucial roles in successfully implementing Zero-Fee Processing while ensuring patients have a positive payment experience. By embracing this approach, dentists can navigate the evolving landscape of payment processing while providing the best value to their patients.

Summary

When it comes to accepting payments for almost anything, including dental care, one thing is clear: credit cards are here to stay. Dental practices need to adapt to the changing landscape by choosing the best ways to accept credit cards. Embracing the best of credit card acceptance is not only the best way for dental practices to increase their revenue but also a strategic move to meet the evolving needs of patients in the modern world.

How PPS helps dentists grow their bottom line

Progressive Payment Solutions is all about helping businesses progress, especially dentists. We understand the unique challenges they face, and we are ready to provide the best solutions to help solve them.

Not only that, but our Zero-Fee Processing program will help dental practices like yours save thousands of dollars on fees and processing costs each year. Schedule a call today with one of our representatives to find out how much money you’ll see in your bottom line each month and how to get started.